That Drinks Business headline claiming the average price of a bottle of US wine hit $56.78 in 2025 is... just not true

One of the UK's most important beverage trade journals shared a shocking statistic: that the average price of a bottle of American wine had risen 11% in 2025, to $56.78. The only problem? It wasn't true.

Today I was shocked to see the featured headline in one of the wine industry news aggregators that is pretty obviously not true. See if you can spot it:

The headline links to a piece in the publication Drinks Business, which is a respected industry publication based in the UK, and was written by Editor Sarah Neish. The only problem? It's making it seem like a tiny slice of the data is the whole story.

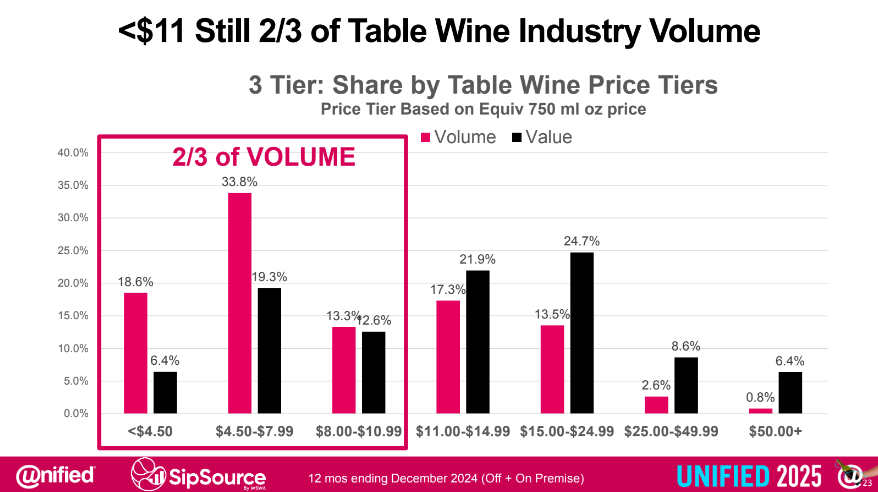

I can see what happened. Tuesday saw the publication of the SOVOS / ShipCompliant Direct to Consumer Wine Shipping Report. This is the industry gold standard for information about the trends that include the wine that is sold and shipped direct from American wineries to American consumers. The problem? The Drinks Business article doesn't anywhere note that this is a small fraction of the wine sold in America. As SOVOS notes on its website, those wines only represent between 10% and 11% of the total volume of off-premise wine sold in America. That total is dwarfed by the wine sold at traditional retail outlets like grocery stores, chains, and independents. And there, the price points tell a very different story. A year ago, at the Unified Grape and Wine Symposium, industry veteran and consultant Danny Brager shared the following slide reminding the audience that wine under $11 still made up two-thirds of the volume of off-premise wholesale wine sales:

By contrast, wines over $50 make up less than 1% of off-premise wholesale sales, and (even with the much higher price per bottle) just 6.4% of value. The average retail price of a bottle of wine sold in America in 2024? Just a few pennies over $10.

Yes, the chart above is for all wine sold in America, not just domestically produced wine. But since 63% of the wine sold here is American-made, you aren't going to see a major difference between the overall average and the average price for domestic wine. You can confirm this with a simple walk around your grocery store's wine aisle. The majority of the cheapest wines there are domestic.

If 10% of the wine (the direct-to-consumer tenth) averages $56.78, and the other 90% averages $10, the true average retail price of wine in the Unites States is something like $14.68. Although I couldn't find any publicly available data to check against, that feels about right.

To what extent does it matter, if an industry publication in the UK publishes a headline article that inflates the actual price of American wines by 287%? It's not insignificant, I don't think. Drinks Business posted the article on their Facebook page (71,000 followers) and on Twitter (80,800 followers) and LinkedIn (98,000 followers). None of these posts has seemed to get much traction yet, but that's still a big audience. I'm honestly most worried about the industry aggregator emails, which go out to thousands of people in the business, each of whom is in a position to influence consumer behavior.

All this matters because it plays into a narrative that is convenient and ultimately corrosive. It's not like our wine industry needs more bad press abroad. American wines saw a 31.4% decline in export sales in 2025 thanks to foreign consumers and governments looking at the United States government's tariff regime and public posturing and deciding they wanted to spend their dollars elsewhere. And the perception of American wine among international consumers was, even before the current administration, that while it can be outstanding at the top end, it doesn't generally offer value. So having these preconceptions reinforced by an article saying that not only is American wine expensive, but also that those prices rose 11% in 2025? That's going to have some of negative consequences.

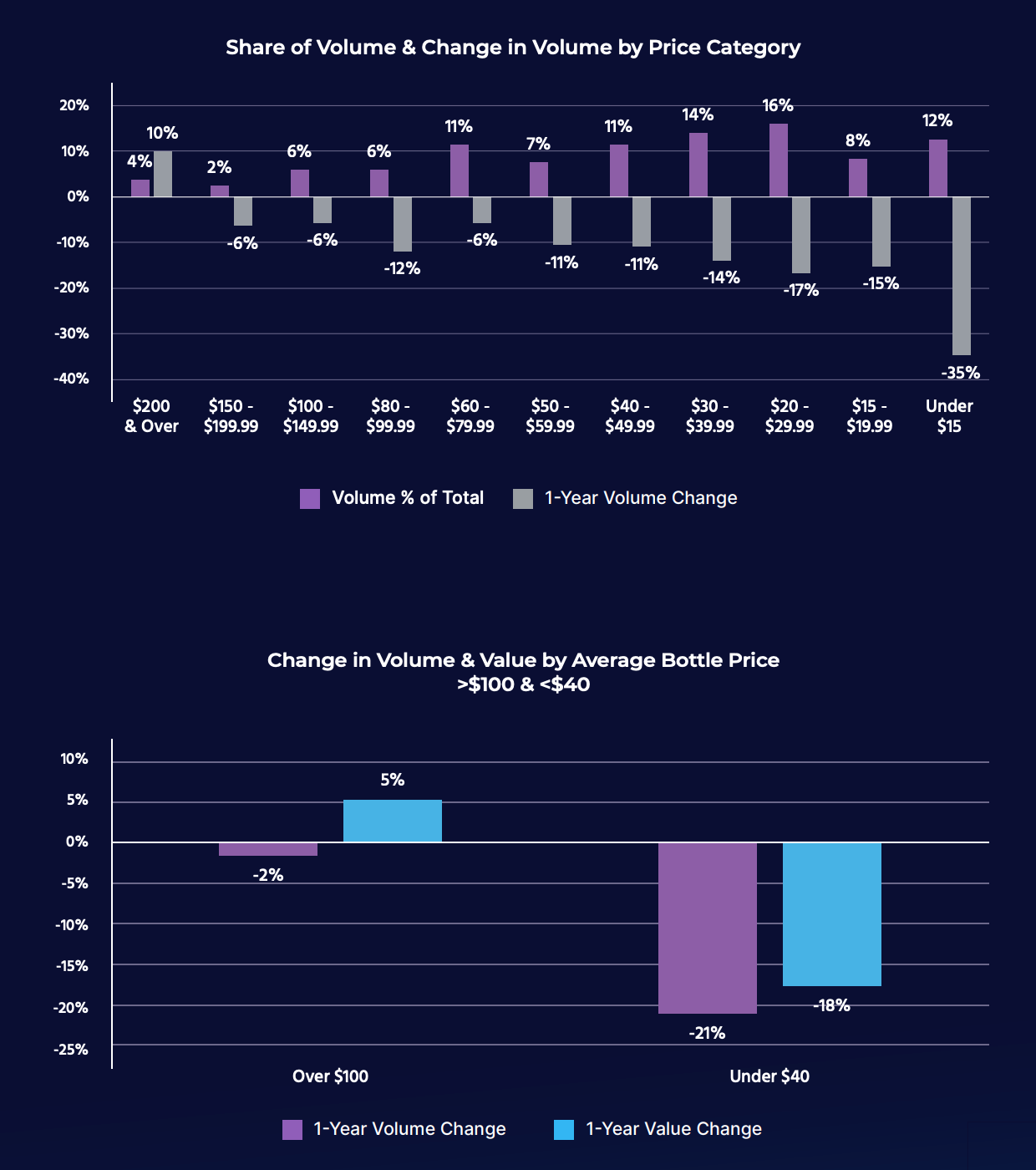

Note that I'm not taking issue with the SOVOS / ShipCompliant report. It's sharing critical data as American wineries chart a path forward in a challenging market. What it reports – that direct to consumer sales of American wines were off in 2025 across all regions and almost all price points – is reflective of a broader shift in the market back toward pre-pandemic norms and due to ongoing demographic changes. But the apparent rise in price is exaggerated by the rapid disappearance in the market of the least-expensive wines. From the report:

What happens when the "Under-$15" category shrinks by 35%? The average price of what is shipped goes up. Does that mean that the wines themselves are seeing higher prices? Not necessarily. You're just seeing people buy a different mix. And that's not necessarily unhealthy. Should a $10 wine be shipped direct-to-consumer, with the likely shipping costs coming close to the cost of the box's contents? I don't think so. Those sorts of wines are likely to only be viable to a winery if they're mass-produced anyway, and who would pay shipping when you can get that same wine at your local supermarket? Only someone who doesn't feel safe shopping in person. As pandemic fears have eased, you'd expect to see reduced volumes of those wines shipped, leaving more of the rarer (and more expensive) wines left in the mix. That actuality is confirmed by the report's authors, who introduce this section with the statement "The trend of fewer lower-priced wines being shipped DtC has been in place since 2021."

As Mark Twain said, "There are three kinds of lies: Lies, Damned Lies, and Statistics.” This is one of those cases where the data seems to offer a convenient narrative. But without the crucial context that this data only represents a tenth of the American retail wine market, it's not just wrong. It's dangerous.